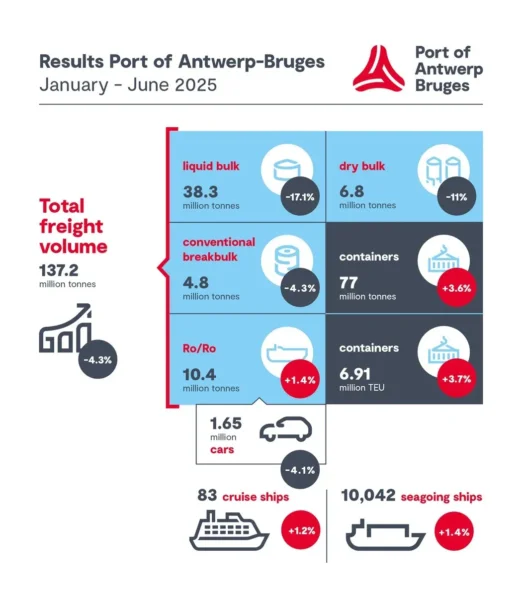

The Port of Antwerp-Bruges handled 137.2 million tonnes of cargo between January and June, a 4.3% decline compared to the same period last year, according to the latest figures from the port authority. Bulk volumes dropped sharply and congestion continued to disrupt operations, but growth in container, RoRo, and particularly US-bound traffic helped to offset the overall decline.

Throughput in both liquid and dry bulk segments fell significantly in the first six months of the year. Liquid bulk declined by 17.1%, largely due to lower volumes of fuels, naphtha, and LNG. Market overcapacity, geopolitical instability, and EU sanctions contributed to the drop. LPG and kerosene were the only categories within liquid bulk to register growth. Chemical throughput increased by 8.9%, driven mainly by biofuels; excluding this component, chemical volumes remained flat.

Dry bulk traffic also fell, with throughput down 11% compared to H1 2024. Reductions in coal and construction material volumes outweighed a marked increase in fertiliser imports. The contrasting trends reflect the impact of EU sanctions on Russian coal and anticipated additional import duties on Russian fertilisers, which have prompted a temporary rise in shipments.

Non-containerised general cargo fell by 4.3%, largely due to weaker steel and iron flows. RoRo traffic rose by 1.4%, despite a decrease in new car shipments, which was offset by growth in truck, high and heavy equipment, and used vehicle volumes. Unaccompanied freight dipped slightly, down 1%.

Container volumes rise amid operational pressures

Container throughput increased by 3.6% in tonnage terms to 77 million tonnes and by 3.7% in TEUs, reaching 6.91 million units. Despite this growth, congestion remained a critical challenge. Disruptions stemming from earlier supply chain issues, the rerouting of vessels around the Cape of Good Hope, and recent changes in container shipping alliances have contributed to scheduling difficulties and high cargo volumes.

As a result, average dwell times at terminals have risen to 7–8 days, up from the typical five. Overloaded terminals require more container movements, adding pressure to staffing and equipment. National industrial action has further strained operations. While vessel waiting times remain relatively limited on the waterside, landside congestion is placing significant stress on terminal operations.

In response, the port is advancing the Extra Container Capacity Antwerp (ECA) project, which includes constructing a new dock and making more efficient use of existing infrastructure.

In case you missed it: This mistake could cost your haulage business €5,000. And Germany’s not messing around

Transatlantic trade continues to strengthen

Trade with the United States rose by 17.2% to 16.4 million tonnes in H1 2025, consolidating the US as the port’s second most important trading partner after the United Kingdom. Imports from the US increased by 13.1% to 9.7 million tonnes, while exports rose by 23.5% to 6.7 million tonnes. Growth was recorded in both container and bulk segments, particularly in fuels and LNG.

Despite the overall rise in US-bound exports, the port reported a notable fall in vehicle shipments. Between January and June, exports of new passenger cars and vans fell by 15.9% to 76,089 units, while exports of trucks and high & heavy vehicles dropped by 31.5% to 11,751 units. The decline has been attributed to the impact of US import tariffs.

Container exports to the US remained stable at 303,000 TEU, while imports rose by 12.6%, possibly reflecting some degree of anticipatory stockpiling ahead of potential trade policy changes.

The outlook for the second half of the year remains uncertain and may be influenced by ongoing negotiations on an EU–US trade agreement, with a possible decision expected by 1 August.

Planning for capacity amid economic uncertainty

Commenting on the figures, Jacques Vandermeiren, CEO of Port of Antwerp-Bruges, said:

“The growth in container traffic proves the strong foundations of Port of Antwerp-Bruges, even as bulk traffic comes under pressure and congestion is felt across North-West Europe.”

He added that the port’s consistently strong trade relationship with the United States underlined its role as a transatlantic gateway, while ongoing operational pressures highlighted the need for expanded container capacity.