According to a Morgan Stanley report as cited by the Wall Street Journal, Uber Freight is currently paying out 99% of its revenue to carriers, compared to an industry average of 80-85%. Market leader C.H. Robinson pays out 83% in their North American operations.

Where’s the growth?

Undercutting the market by that much is an obvious ploy to buy a market share (by offering lower per-mile pricing compared to the industry to shipper customers) and improve carrier engagement (by offering higher per mile rates to carriers).

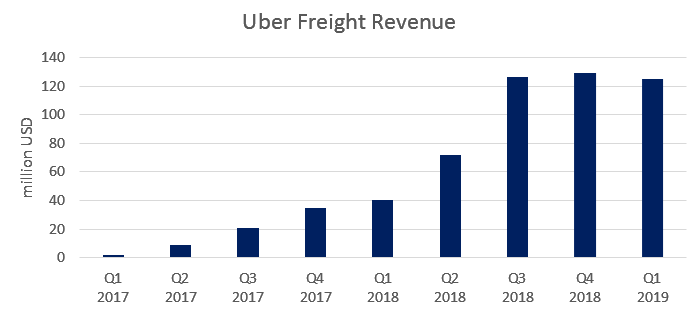

It doesn’t seem to be working anymore though. Morgan Stanley cites Uber Freight being on a $125m per quarter revenue rate in Q1 2019, which is no growth compared to the last two quarters.

Getting to the annualized $500m run rate from basically scratch in two years is quite impressive, but what counts now is growth. As a comparison, C.H. Robinson’s North American unit had revenue of $11.2bn last year.

Exploding costs?

In true Uber-style, the losses at Uber Freight are spectacular. The unit lost $71m in Q1 alone. Some of that is spent subsidizing freight. Using the C.H. Robinson figures, that’s about $20m per quarter, meaning Uber Freight would be at $21.3m in revenue if it had their gross margin.

C.H. Robinson then has a 43% operating margin, paying for everything from staff, marketing to IT. At a similar operation, that’d cost UberFreight then $12.1m, leaving almost $60m in spent in excess of levels that established brokers have. And still no growth?

Conclusions for established brokers

First – as I have highlighted in an earlier piece on Amazon’s recent market entry – any carrier can subsidize pricing, and it is often cheaper than expected. Subsidizing pricing certainly hasn’t been invented by Uber Freight, Amazon, or Convoy.

Second, there’s at least in the short term a limit to growth by subsidized pricing. Even at the substantial discounts offered, growth remains to be flat.

Source for the figures: Uber S1, Wall Street Journal, C.H. Robinson.

The Uber figures are for the “Other Bets” unit which primarily holds Uber Freight

Alexander Hoffmann is the Co-Founder & Managing Director at TNX Logistics.

Photo: Pixabay