The United States is the largest recipient of EU exports among all third countries, accounting for over 20% of EU exports (as of 2024). The United Kingdom (13.2%) is behind it, with a significantly lower share, followed by China (8.3%). In terms of EU imports, China dominates (21.3%), although the United States is close behind (13.7%), ahead of the United Kingdom (6.8%).

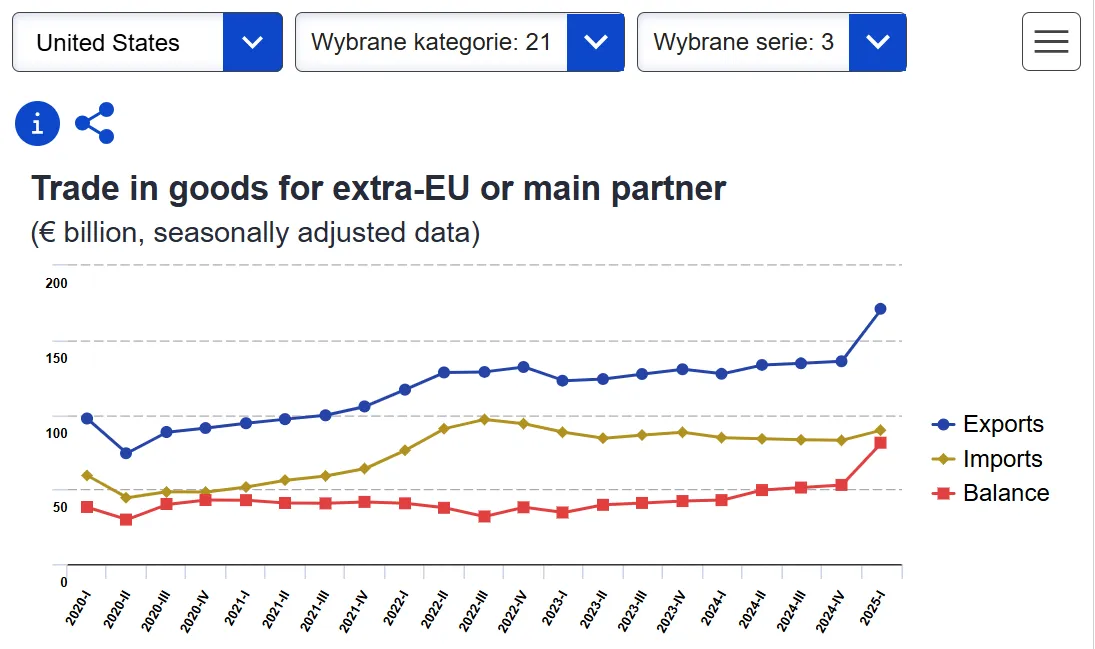

Since the first quarter of 2023, the European Union’s trade balance with the United States has steadily increased, from €34.5 billion to nearly €53 billion in the fourth quarter of 2024. However, a sharp increase occurred in the first quarter of 2025 , when the value of both exports and imports soared, with the former increasing by over €35 billion. This led to an increase in the EU’s trade balance to over €81 billion.

The boom in exports and imports was caused primarily by the threat of a trade war with the United States, argues Eryk Grykień, coordinator at SPRINT Logistyka Polska and an expert at WSB University Merito Szczecin in the field of logistics.

“There has been an acceleration in trade. Importers on both sides are stockpiling to get ahead of the new tariffs. Of course, there’s a risk that this strategy will backfire when these inventories become too large for demand and, consequently, they’ll have to dispose of them, significantly lowering prices. However, logistics has a way of exploring various options and determining the appropriateness of a stockpiling strategy at a given moment,” comments Grykień.

The surge in exports and imports is also the result of increased consumption, a certain economic recovery, and the dynamic development of certain sectors, such as technology and defense. “The seasonal effect, consisting of an increase in trade in the first quarter, is also significant,” the expert admits. “Nevertheless, I would attribute the greatest impact to the ‘desire to escape’ tariffs.”

Read more: Trump wants 30% tariffs from EU by August 1

Trump threatens tariffs. Is there anything to worry about?

And these can be clear. As a reminder, less than two weeks after his inauguration as President of the United States, Donald Trump announced the introduction of tariffs on European Union member states. “The EU treated us terribly,” he explained.

And indeed, in March, 25% tariffs were imposed on European cars and steel, among other items. In early April, a general tariff rate (10%) was announced, along with additional tariffs on certain countries, including 20% on the European Union. However, tariffs (apart from the general tariff rate) were suspended, and negotiations began, which continue to this day.

“If tariffs come into effect—and they could be very high, as at one point there were threats of tariffs as high as 50 percent—we must expect supply chains to be transformed, and above all, stretched. Goods will have to pass through, as they say in freight forwarding, four hands, which means the emergence of new countries and terminals along the route of specific cargoes. This will necessitate establishing cooperation with local partners in the United States or other countries where these customs barriers will be lower,” explains Eryk Grykień.

“In the face of these changes, the best strategy for all entities—both large logistics operators and smaller carriers—will be to invest in new technologies and automation. Data analysis and modeling of various cost scenarios will be essential to making rational business decisions. The faster and more agile will win,” the expert adds.

He also admits that it will also be necessary to seek to renegotiate contracts so that the low margins that dominate the TSL industry don’t drive businesses into bankruptcy in the face of rising costs resulting from more complex and intricate supply chains. And, of course, the aforementioned tariffs.

How has the European trade balance with third countries changed?

Meanwhile, the increase in the trade balance with the United States had a significant impact on the trade balance with all third countries. In the first quarter of 2025, the latter reached €54.95 billion. This was the best result since the first quarter of 2021.

Trade with Switzerland also had a significant impact – the trade balance in the first quarter of this year amounted to over €22 billion (compared to almost €12 billion in the fourth quarter of 2024). Trade relations with this country have not seen a better result in the last five years.

The trade balance with the United Kingdom also increased slightly (from €44.75 billion in the final quarter of last year to over €46 billion this year) and with Russia – although in the latter case, not only was it small but it still remained negative. In the fourth quarter of 2024, the trade deficit with Russia amounted to €1.9 billion, while in the first quarter of this year it was €0.75 billion in the red.

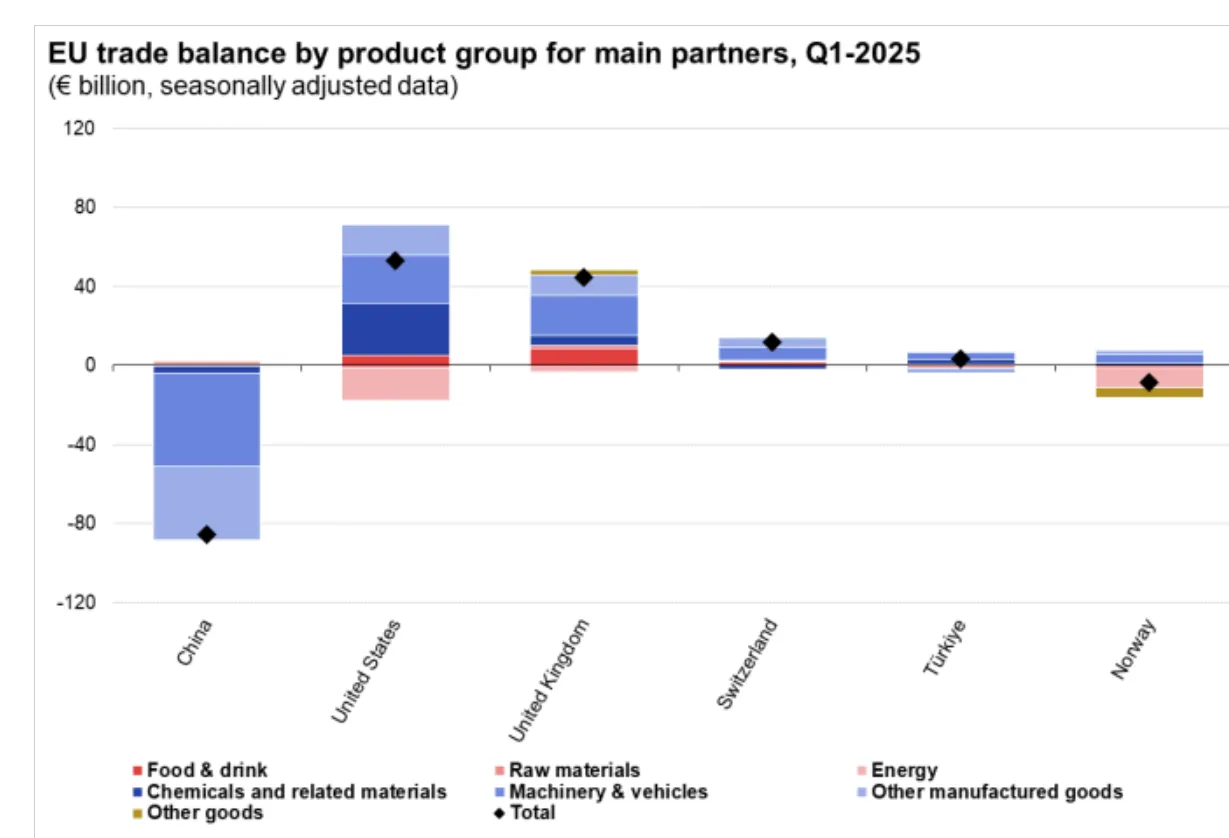

During this time, the EU’s trade balance with China decreased (from minus 85.6 billion euros to almost minus 92 billion euros), Norway (from minus 8.4 billion euros to over minus 9 billion euros) and Turkey (from 3.3 billion euros to 2.73 billion euros).

In case you missed it: US tariffs shake ocean and air freight flows in Q2 2025

What does Europe import?

Russia, Norway, and above all, China – in its trade relations with these countries, the European Union imports more than it exports. In China’s case, this deficit is primarily due to imports of machinery and transport equipment, as well as other manufactured goods. In Norway, it is due to imports of energy products and other goods.

In turn, the surplus in trade with the United States in the first quarter of 2025 was driven by exports of chemicals and related products, as well as machinery and transport equipment (the European automotive sector is a beneficiary of trade with the US). Other manufactured goods also benefited to a lesser extent. Imports from the US to the European Union were primarily energy products. Incidentally, the country is currently the largest supplier of crude oil (accounting for 15% of EU imports by value) and liquefied natural gas (over 50%).

In Switzerland, the surplus was achieved primarily through exports of machinery and transport equipment and other manufactured goods. The same was true for Great Britain, with an additional large share of food, beverages, and tobacco.

“If the United States imposes tariffs, we can expect Asian markets to gain importance in Europe. On the one hand, this means a risk of dependence on Chinese suppliers, but on the other, it could suggest promising development directions for transport companies. Besides China and countries on the so-called New Silk Road, Norway could also be such a destination, given its importance in importing energy products to the EU,” advises Eryk Grykień.