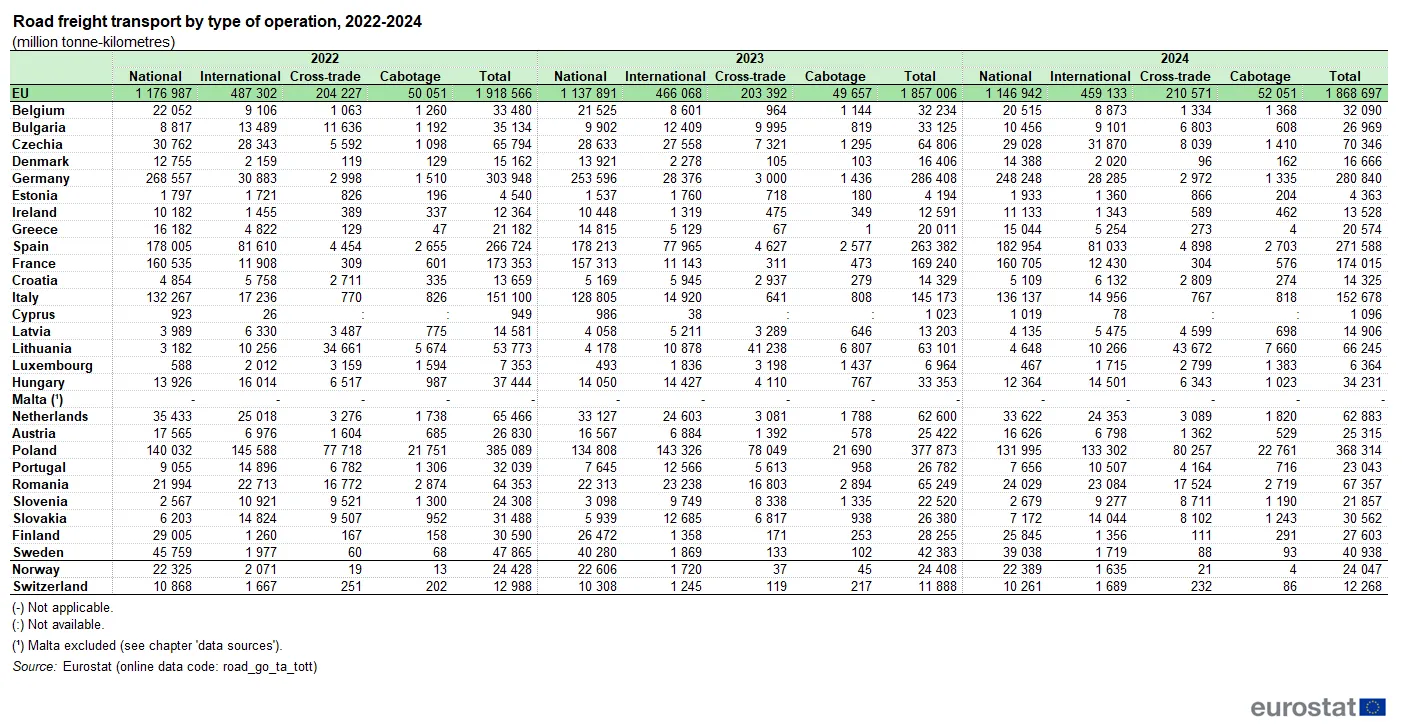

Between 2022 and 2023, EU road freight volumes fell by 3.2% (from 1,919 to 1,857 billion tkm), followed by only a modest recovery of 0.6% in 2024.

Although the figures suggest stabilisation, international freight—which made up 25% of total EU road transport in 2024—continued to contract. It fell by 4.4% in 2022–2023 and a further 1.5% in 2023–2024.

Domestic transport, which accounted for 61% of total freight activity within the EU, also shrank by 3.3% in 2023 before recording a slight increase of 0.8% in 2024.

In contrast, cabotage and cross-trade rose significantly—by 4.8% and 3.5%, respectively—indicating that transport companies are increasingly seeking more profitable operations outside their home countries.

EU road freight by type of operation, 2022–2024:

In case you missed it: Drivers offered container sleep pods at logistics centre

Poland still leads—but is losing ground

Poland remained the EU’s largest road freight operator in 2024, with a 19.7% share of total transport (368 billion tkm), ahead of Germany (15%, 281 billion tkm) and Spain (14.5%, 272 billion tkm).

However, this marks a downward trend: Poland’s share was 20.3% in 2023 and 20.1% in 2022. While it still leads the EU, the falling share may point to growing competition or weaker demand in international transport.

According to Eurostat, international, cross-trade, and cabotage operations accounted for 64.2% of Poland’s road freight activity, with domestic transport making up 35.8%.

In total, five countries—Poland, Germany, Spain, France (9%, 174 billion tkm), and Italy (8%, 153 billion tkm)—were responsible for 67% of EU road freight in 2024. Among smaller economies, the Czech Republic (70 billion tkm), Romania (67 billion), Lithuania (66 billion), and the Netherlands (63 billion) stood out.

Fifteen EU countries reported year-on-year increases, led by Slovakia (+15.9%), Latvia (+12.9%), and the Czech Republic (+8.5%). Ten countries recorded declines, with the sharpest drops seen in Bulgaria (-18.6%), Portugal (-14%), and Luxembourg (-8.6%).

Further reading: Hauliers warned: Netherlands plans roadside AdBlue checks

Germany remains a central hub

Germany retained its role as the EU’s key freight hub, serving as the origin or destination for nearly half of the top 20 cross-border freight flows within the Union. On the EU’s external borders, transport relations with Switzerland, Norway, and the UK dominated.

Interestingly, while Germany handles the highest geographic freight volumes, its domestic operators play a limited role. For instance, only 3.6% of freight between Germany and Poland was transported by German hauliers. In many cases, Polish operators account for a significant share of cross-border transport involving Germany.

Further reading: This mistake could cost your haulage business €5,000. And Germany’s not messing around

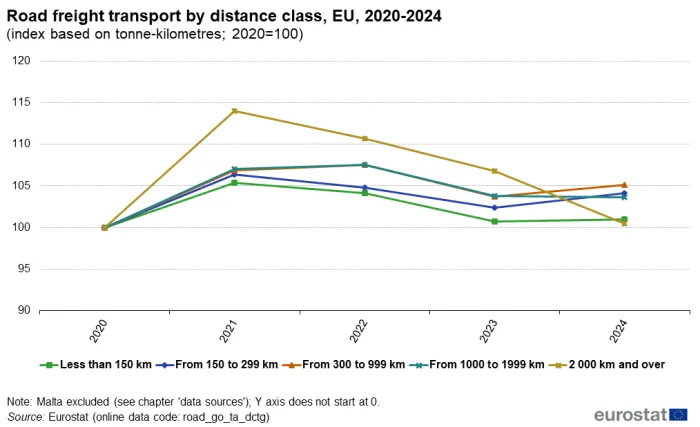

Shift towards medium-distance transport

In 2024, most freight was moved over distances of 150–999 km, totalling 1,126 billion tkm—up 1.5% year on year. By contrast, long-haul transport (over 2,000 km) declined by 6.3%.

Poland (219 billion tkm) and Germany (175 billion tkm) were the largest contributors to medium-distance routes. Transport over short distances (under 300 km) fell by 1.1%, while transport above this threshold rose by 1.4%, underlining the growing importance of medium-haul routes.

EU road freight transport by distance, 2020–2024:

Growth in FMCG, decline in raw materials

By tonne-kilometres, volumes remained stable across the dominant categories:

- Food, beverages and tobacco: 312.2 billion tkm

- Grouped goods: 236.5 billion tkm

- Agricultural products: 207.6 billion tkm

- At the same time, notable declines were observed in:

- Coal and lignite: -67.6%

- Metals: -6.4%

- Coke and refined petroleum products: -3.7%

By contrast, transport of “other unspecified goods” rose sharply by 22.4%.

Further reading: Germany rebounds, France lags as eurozone PMI stabilises in June