CMA CGM reported second-quarter revenue of USD 13.2bn, unchanged from the same period last year, as continued geopolitical instability and disruption in the Red Sea weighed on its core maritime operations. Group EBITDA declined 7.9 per cent year-on-year to USD 2.3bn, with the margin narrowing by 1.5 percentage points to 17.3 per cent.

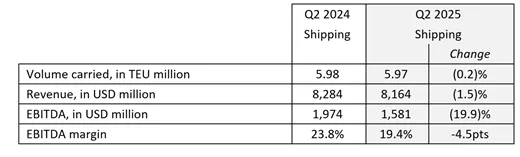

The French container shipping and logistics group said volumes carried remained stable at 6.0 million TEUs, despite a sharp but temporary fall in trade flows between China and the United States. Shipping revenue declined 1.5 per cent year-on-year to USD 8.2bn, while EBITDA dropped 19.9 per cent to USD 1.6bn. The EBITDA margin fell by 4.5 percentage points to 19.4 per cent, as average revenue per TEU edged down 1.2 per cent to USD 1,367.

CMA CGM said the near-stability in volumes reflected its ability to redeploy vessels and capture demand across other global trade lanes. The company continues to face significant operational disruptions linked to instability in the Red Sea and Gulf of Aden, which have affected key maritime routes. It cited the geographic breadth and flexibility of its network as important factors in maintaining service levels under pressure.

“In a context marked by persistent geopolitical tensions and renewed trade uncertainties, our Group is delivering a stable performance, driven by the resilience of its maritime activities,” said Rodolphe Saadé, CMA CGM’s chief executive.

Image credits @ CMA CGM

Diversification into logistics and terminals lifts group margin

Logistics revenue totalled USD 4.6bn. While slightly lower than the prior quarter, EBITDA rose 2 per cent to USD 459mn, supported by contract logistics. The Group cited ongoing weakness in the European automotive sector as a drag on finished vehicle and road freight performance.

Other activities, including air cargo, media, and terminal operations, delivered revenue of USD 1bn, a 62.7 per cent increase year-on-year. The segment benefited from the integration of Brazilian terminal operator Santos Brasil. EBITDA rose to USD 239mn from USD 51mn a year earlier.

“These results also highlight the relevance of our diversification strategy across terminals, logistics and air freight, which enables us to offer global solutions and adjust our operations more swiftly to shifts in global trade,” Saadé added.

The company continued to invest across its portfolio, including acquisitions and joint ventures in Brazil, Egypt, India, Vietnam, and France. In Brazil, CMA CGM acquired a 51 per cent stake in Santos Brasil, the largest container terminal in South America. In Egypt, it took a 35 per cent stake in the October Dry Port terminal.

In case you missed it: Rerouted ships lost hundreds of containers off South Africa in 2024

CMA CGM expands dual-fuel fleet amid decarbonisation drive

Progress on decarbonisation included the addition of several dual-fuel vessels. The company now operates LNG-powered ships of 8,000 and 23,000 TEU capacity, as well as methanol-fuelled vessels of 13,000 TEU. CMA CGM expects to field at least 162 dual-fuel ships by 2029, including 24 methanol-powered units. A new LNG bunkering joint venture with TotalEnergies is set to bring a 20,000 m³ bunker vessel to Rotterdam by 2028.

The company’s air freight business expanded with the takeover of Air Belgium’s cargo operations. In media, CMA CGM entered exclusive talks to acquire digital outlet BRUT and launched an AI-powered article-listening feature via La Provence.

CMA CGM said it remained cautious on the outlook, citing macroeconomic uncertainty, regional conflicts, and evolving trade policy as continued risks. It added that operational flexibility and cost control would remain priorities amid volatile market conditions.