Internally, any variability of supply due to unplanned events may prevent the company from achieving its demand-driven output targets. Externally, fluctuations in capacity supply and demand from other seekers of the same capacity pose challenges to efficient operation of their supply chains. One way to reduce the level of uncertainty is by making contractual agreements in lieu of seeking and buying capacity on the spot.

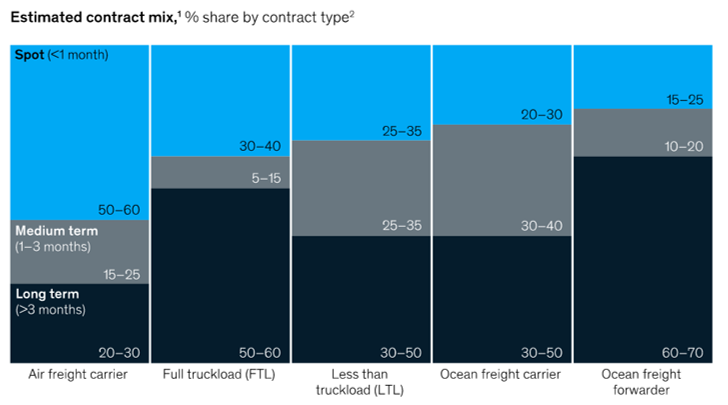

In our context, a contract, whether for long period or spot, is a binding agreement in which the carrier provides specified capacity in specific location(s) at specific time and the buyer pays for it under specific terms and conditions. The contract selection problem is to find a way to select which type of contracts to use given the structure (price, quantity, commodity) of all different contract types available.

While the spot buyer is completely at the mercy of carriers’ decisions, longer term contract optimization is not easy either, as the buyer and the seller will account differently for their expectation of rates, capacity supply and risks over multiple time horizons.

At a recent shipping conference, participants were asked a question: “Have you changed your carriers contracting policies as a result of the ongoing crisis of capacity, transit times and escalating rates?”. Not surprisingly, about 70% of people voting answered “Yes”, but to the follow up question “Have you been able to secure types of contracts that your business desire under current conditions”, the majority answered “No”. Currently, it seems the carriers on sea and land hold all the cards and push all the levers in order to optimize their business for their own profitability and efficiency.

Even when it comes to contracts, the carriers can afford to be very selective. This is reflected in carriers’ strategies of reducing number of customers offered contracts and pushing everybody considered non-strategic to the spot market. That change created an unprecedented chasm between the lowest long-term contract rates paid by the largest shippers and the highest rate in the spot market paid by the smallest shippers. For example, the spread for ocean freight is now as high as 10 times of what it was before covid-19 pandemic started.

What should be my strategy now?

Let’s consider situation of a capacity buyer who can negotiate with the carrier for either long term contract or buy at carrier’s spot rate. This is not a simple matter of comparing two prices. Context of supply chains logistics requires evaluation of more options than the pricing. Other criteria include (1) specification of decision rights, (2) minimum purchase commitments, (3) quantity flexibility, (4) allocation rules, and (5) transit time (and/or any other quality factors in addition to transit time).

Looking at the current market, shippers of low-margin goods contracting directly with the carriers or contracting with a freight forwarder for a specific carrier are probably better off playing the spot market rather than entering long term contracts. If your business falls into this segment, the carriers will not offer you any breaks for now and you will be the price taker. The spot rates are slowly, but surely, drifting down from their peaks, so the carriers may be motivated to sign long term contract with you to preserve their margins. There is one key problem with the spot rates. Guaranteed capacity, departure, and transit time is only available on the premium spot rates, but many carriers removed the premium rates on many O-D pairs, if not whole trade lanes.

Shippers of high-margin and high-value commodities naturally lean toward long term contracts with sporadic spot booking. If your business falls into this segment, you should be very careful of contract durations and the adjustment factor. Reportedly, carriers prefer to tie the adjustment to the monthly Container Trade Statistics index built by the carriers themselves, rather than to the more neutral weekly Shanghai Containerized Freight Index. With that in mind, going multi-year above the 12 months could result in paying significantly higher rates 2 years from now for not much benefit above of what the spot premium rate would give you.

Can information technology solutions help?

Through my work with computer-based solutions utilizing mathematical optimization to achieve the best possible decision, I often answer questions on the extent of using deep learning type of artificial intelligence to determine which option of many available should be taken by the decision maker. Achieving that is near impossible with the current state of the information technology.

Most importantly, you should not count on transportation management systems (TMS) to provide you with a decision making engine. TMS systems were not designed for such purpose. You could consider marrying your TMS to a benchmarking platform like Xeneta or NYSHEX, but those will only provide data on ocean rates (port to port), not the full length of your supply chain that includes land/inland waters transportation.

Another option is to marry your TMS to an external multi-modal rating platform that uses some form of intelligent analytics to inform your contract vs. spot decision. Be cautious of the overhyped claims of using AI, as in many cases AI is mentioned only for marketing purposes. Companies like Shippabo, Freightos, Descartes, Wisetech, or Shipsy claim that if you send your rate inquiries through their platforms, they will advise you if it is better to contract or to continue buying at spot rate(s). I found those claims to be mostly unfulfilled and there is little transparency how their technology can reliably make forward-looking decisions involving so many shipper-specific factors.

Then there are the “digital” forwarders like Forto (ex-Freight Hub), Flexport, Twill, Zencargo, and many others, who will manage, negotiate and allocate your cargo on your behalf under contract with your company. You will have very little visibility into the logic embedded in their rating engines and decision support technologies. Their business model is identical to that of a conventional freight forwarder. Strength of their relationships with sea and land carriers vary and they are not completely neutral in their carrier allocations either. They may preference the carriers they themselves contracted with and obtained preferential rates from predicated on the volumes they will deliver on behalf of shippers like you.

Conventional freight forwarding and 3PL companies may not hype their “digital” credentials, but their business model also depends on playing the arbitrage in the global market of prices offered by the carriers. That buy low/sell high model works to the advantage of their bottom lines, and unlike the “digital freight forwarders”, they may use rudimentary IT tools like transportation management systems with souped up quote portal to identify a small number of routing options. They prefer signing customers to long term contracts, but some will enter into spot transactions. Keep in mind that the smaller the freight forwarder, the thinner the technology layer and simpler the tools.

If you found this topic interesting, leave your comment or suggestion. I will be happy to listen and respond. If you are looking at your freight rate procurement strategy and contract optimization and/or debating how to use information and data technology to your advantage, please reach out to me for unbiased consulting advice.

All my writings draw on real life business experiences with my clients. Asian examples feature big, because I live and work in this region and see its dynamics first hand. If that interests you, please follow me to receive the latest updates.

This article originally appeared on Kris Kosmala‘s LinkedIn Page. Trans.INFO is very grateful to Chris for allowing its republication.