Germany is currently the most important transport market in Europe. In the first half of 2024, 1.351 billion tonnes of cargo were transported within Germany and on routes to and from the country. This accounted for 21.1% of the total tonnage moved within the European Union.

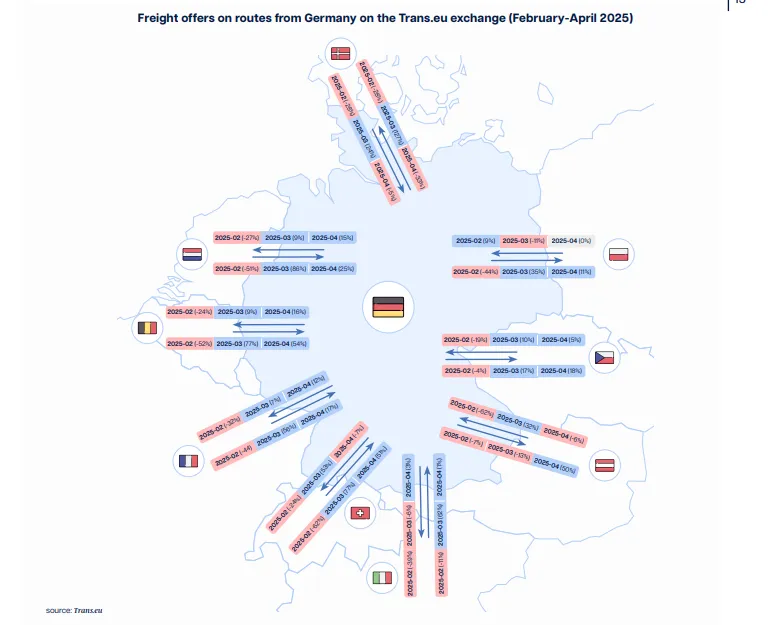

As economic indicators for Germany show a slight upward trend and the broader situation gradually improves (albeit still far from optimistic), there has also been a noticeable increase in customer activity on most routes to and from the country. During the period analysed in the report, the number of freight offers to France – the EU’s second-largest economy – rose month-on-month by 7% in March and 12% in April 2025. The route to the Netherlands also recorded strong growth, with increases of 9% in March and 15% in April. It is worth noting that the corridor between Germany and the Netherlands is the most important in Europe in terms of volume.

Demand for transport to Italy grew less dynamically – rising just 3% in April, following declines in February and March. On the other hand, after a dip in February, freight offers on the route to Poland increased over the following two months.

However, routes to the Czech Republic and Belgium recorded particularly strong double-digit growth. In March and April, the number of freight offers on the Czech route rose by 17% and 18%, respectively, compared to previous months. In contrast, two routes heading south – to Austria and Switzerland – lagged behind this general trend. Both February and April saw declines in freight availability in both directions on these corridors. While February was a weak month on several routes (including Italy and Belgium), permanent increases followed in March and April – except in the case of Germany’s two Alpine neighbours.

A separate case is the Germany–Denmark corridor, which also recorded declines in freight offers in both February and, notably, April.

Exodus of carriers

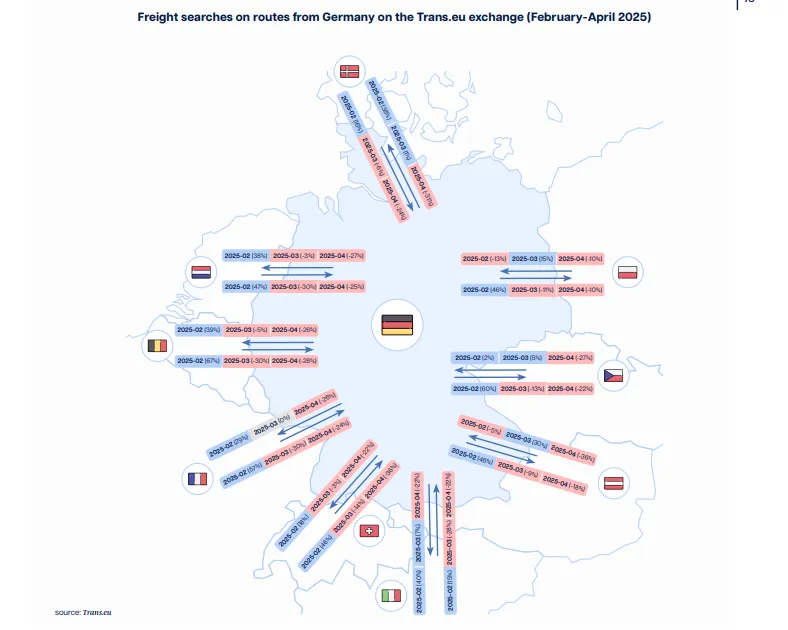

The period under review began with a rise in the number of cargo searches on German routes in February (following a weak January). However, in March the trend reversed, leading to a notable exodus of carriers from the German spot market. The decline in carrier activity in March and April was especially noticeable on the route from France, with month-on-month drops of 30% and 24%, respectively. A similar fall was seen on the Netherlands–Germany route (30% in March and 25% in April), while the Italy–Germany route recorded a decline of over 20% in April.

On the Poland–Germany corridor, the decrease in carrier activity was less marked, though still amounting to 10% fewer cargo searches. This contrasts with the strong growth in demand observed on most of the above-mentioned routes – though Poland was affected to a lesser extent than the Western markets. Does this mean that carriers active on the German market have begun looking elsewhere? The data from the first few months of this year suggests otherwise. Drops in cargo searches were also recorded on other routes linking Germany with neighbouring countries – often sharp and widespread, as seen on the key European corridors.

While February saw an increase in search activity compared to January, March and April brought a marked slowdown. Looking at routes to and from Austria, Belgium, the Czech Republic and Switzerland (a total of eight directions), searches dropped on six of them in March – and on all eight in April. In several cases, month-on-month declines exceeded 30%.

The fall was especially steep on the Belgium–Germany route, with 30% fewer searches in March and 28% fewer in April. A similarly sharp drop was seen on the Switzerland–Germany corridor (14% and 36%, respectively). Searches on the Denmark–Germany route also dropped by around a third. In April, the only route where the decline in searches did not exceed 20% was from Germany to Austria.

Rates spike

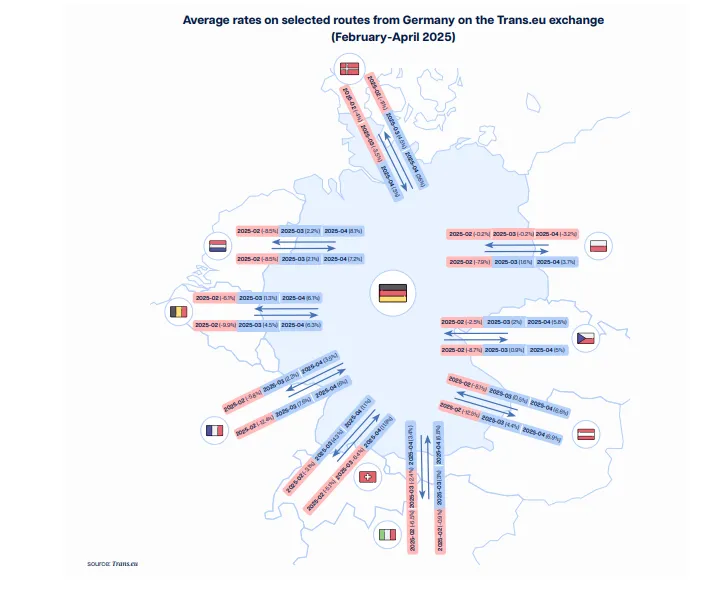

February 2025 brought an unexpected price correction on routes to and from Germany, as all the corridors analysed in this section saw a drop in median freight rates compared to the previous month. However, the following two months marked a return to growth.

In March, rates fell month-on-month on just four routes: from Switzerland, Poland and Denmark to Germany, and on exports to Italy. In contrast, April saw rate increases across all routes – and some were substantial.

The most notable increase was on the Germany–Denmark route, where rates surged by 36% compared to March. This was significantly higher than the next sharpest increase – 11.9% on the Switzerland–Germany corridor. Notably, this route had seen falling prices in both February and March.

The rise in rates on the Alpine corridor correlates with a dramatic increase in the number of loads posted on this route (up 77% in March and 51% in April) and a sharp decline in available transport capacity (down 14% and 36%, respectively). However, this was not the only route where April brought double-digit rate growth. The France–Germany corridor also saw a 6% rise (following a 7.6% increase in March), while similar increases were recorded in both directions between the Netherlands and Germany. More modest growth was noted on the Italy–Germany route.

Other corridors experienced smaller rate increases – in March typically up to 2% month-on-month, and in April no more than 6–7%. There were, however, some anomalies, such as the Germany–Switzerland route, where the rate increase in April amounted to just 1.1%.

Across most routes, there was a noticeable pattern: rates rose slightly more in the direction of Germany than on outbound routes. That said, the largest single increase occurred on the outbound Germany–Denmark corridor.